Know Your Business (KYB) Checks

Simplify and Streamline the Onboarding Process with KYB Checks

When it comes to data verification and validation, Melissa is the preferred choice for a Know Your Business (KYB) solution that can identify and verify the validity of business data in multiple countries and regions worldwide. Melissa’s KYB solution enables organisations to mitigate risk and achieve regulatory compliance by automating the administrative burden of required regular checks.

- Identify and verify businesses for any current and future B2B relationships.

- Verify against government sources in multiple countries and regions, including: the United Kingdom, United States, Western Europe, China, Australia and more

- Verify Company Name, Address, and Business ID, among other attributes.

- Enrich business information for select countries.

- Reduce manual reviews with real-time identification of high-risk businesses.

- Fully automated to speed up onboarding & reduce manual intervention from your team.

Why are KYB Checks needed in today’s world?

Managers often perform a cursory look-up against common and publicly open data sources such as company registers. In many cases, this type of check may not suffice as businesses face increasingly sophisticated fraud and financial transaction risks, as well regulatory compliance. Therefore, a flexible and more universal Know Your Business tool is required to perform a comprehensive and representative check of a business entity.

How Does Our KYB Process Work?

The Melissa KYB knowledge base is exposed via a single, modern, fast, secure REST API endpoint or as a no code, out of the box service.

The service accepts company data attributes, e.g., names and addresses. The response comes in a JSON format, making it easy to consume by third-party applications such as client or vendor onboarding applications or ERP/CRM products that allow integrations.

Our KYB service provides a structured response and a list of result codes that help the user interpret the result.

Demonstrating Melissa KYB with a Flask-Based Python Web App.

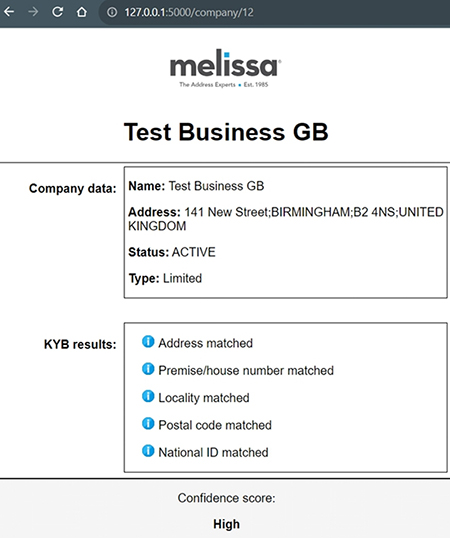

A simple Python web app built with Flask demonstrates the capabilities of the Melissa KYB tool. The app has individual pages for each test company, displaying a business card-like summary of KYB checks with real-time information from the Melissa API.

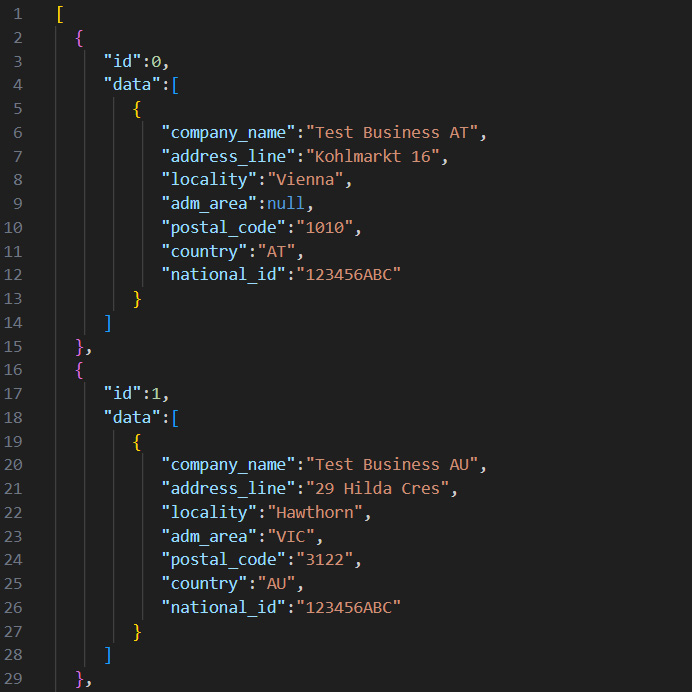

Input data is stored in a static JSON file, though it could come from other sources in practice. Each company page uses the Melissa API to validate information from the KYB database.

For example, the Austrian company "Test Business AT" is confirmed active with a legal form of GmbH and a high confidence score, indicating it is a legitimate entity.

Single, Batch Scan &

No Code Features

Single Scan

Through our single scan feature, individuals and entities can be checked against global data sets and real-time reference data. The results returned will provide a wealth of information that will aid in the onboarding and due diligence processes for new or existing business relationships.

Batch Scan

Melissa’s ID verification tools also have the capability to batch scan, helping businesses save time during the onboarding process by simultaneously checking a large number of entities against their chosen ID checking method. A good option is to use Melissa’s full service eIDV platform to undertake such checks.

No Code

Melissa’s electronic identity verification (eIDV) tools now come in a no code, out the box service which takes out the hassle of integration and lengthy set-up procedures. Just simply create an account via our online portal and gain instant access to our eIDV service.

Explore Our Range of Features Available

Melissa’s identity verification utilises a range of industry-leading services, which are flexible and designed for organisations of all sizes, to meet KYC & AML compliance needs. Our additional identity verification solutions include:

Frequently Asked Questions

KYB is a process that businesses use to verify and authenticate the identity of their corporate clients or partners. It involves collecting and verifying information to ensure compliance with regulations and to mitigate the risk of fraudulent activities.

KYB is crucial for businesses to establish the legitimacy of their corporate relationships, assess potential risks associated with business partners, comply with regulatory requirements, and maintain a secure and trustworthy business environment.

KYB processes help businesses make informed decisions about their corporate relationships, prevent fraudulent activities, ensure compliance with legal obligations, and safeguard their reputation in the business community.

While there are general principles and guidelines for KYB, specific regulations may vary by country or region. Businesses conducting international transactions may need to adapt their KYB processes to comply with the regulatory frameworks of different jurisdictions.

Challenges in KYB implementation include the need for thorough due diligence, managing the complexity of cross-border transactions, and staying abreast of evolving regulations that impact corporate identity verification.